6:27 PM Gardiner Nancy B implements 315 promotions CVS Health Corp (NYSE:CVS) | |

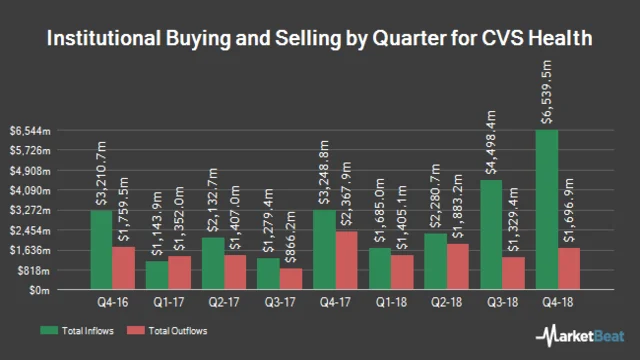

Gardiner Nancy B cut her own holdings of CVS Health Corp (NYSE:CVS) promotions by 2.5% in the fourth quarter, consistent with her last filing with the securities and exchange Commission. The company had 12 189 promotions pharmacy operator subsequently implement 315 promotions in the direction of the quarter. The share of CVS Health falls within 1.6% skladyvalos satchel Gardiner Nancy B, actually what makes it the 24th largest holding. Gardiner Nancy B's holdings in CVS Health were worth $799,000 at the time of his last SEC filing. A number of other institutional traders have recently entered the configurations in their own positions in the summary. Morgan Stanley in the 3rd quarter increased its own position in CVS Health by 7.9%. Morgan Stanley now has 9,018,238 promotions pharmacy operator for the required amount of $709,914,000 subsequently purchase additional 659,975 promotions in the direction of the last quarter. Guild Investment Management Inc. bought a fresh stake in CVS Health in Q3 for $ 3,764,000. Capital International Investors increased its share in CVS Health by 5579.8% in Q3. Capital International Investors now holds 9,161,488 pharmacy operator promotions at a price of $ 721,192,000 followed by the acquisition of additional 9,000,188 promotions in the last quarter. Butensky & Cohen Financial Security Inc. increased its own share in CVS Health by 1.5% in the 4th quarter. Butensky & Cohen Financial Security Inc. at the moment, it has 27,715 promotions of the pharmacy operator at a price of $1,816,000, followed by the acquisition of additional 409 promotions in the last quarter. After all, Korea Investment CORP raised its own stake in CVS Health by 26.1% in Q3. Korea Investment CORP currently has 677,357 promotions pharmacy operator, valued at $53,322,000 subsequently the acquisition of an incremental 140,209 promotions in the last quarter. Institutional traders and hedge funds have 87.22% of the firm's promotions. In the news, economic Director David M. Denton implemented 25,159 promotions in the deal on Thursday, November 29. The promotions were sold at an average cost of $80,13, for a joint required transaction amount of $2,015,990.67. Subsequently, the closing of the deal, the economic Director now directly owns 403 promotions of the company at a price of $ 32,292.39. The conspiracy was disclosed in the file with the SEC, access to which is possible to obtain on this link. Apart from this, the key operating Director of Jonathan C. Roberts implemented 77,639 promotions in the transaction, dated Friday, February 1. Promotions were sold at an average cost of $ 64,54, joint price of $5,010,821.06. Information about this resale can be found here. Over the past 90 days, insiders have implemented 435,534 promotions of the company at a price of $ 29,245,258. Insiders have collective 0.53% promotions company. Promotions CVS Health stock was trading up at $1.84 in the direction of trading hours on Friday, reaching $69.53. Promotions firms had the size of a trading 10,211,516 promotions, compared with its average size 9,763,630. CVS Health Corp contains a 12-month minimum of $60.14 and a 12-month maximum of $82.15. The market capitalization of the company is $ 70.84 billion, the ratio of P / E - 11.78, the cost-to-profit growth of 0.91 and the beta version of 1.03. The firm contains a debt-to-personal ratio of 1.66, a current liquidity ratio of 2.44 and a quick liquidity ratio of 1.94. A number of promotion specialists commented on CVS promotions. Royal Bank of Canada set the price target at $ 99.00 on CVS Health and gave the promotion a “buy” rating in a research note on Tuesday, October 23. Morgan Stanley set the price target at $100.00 on CVS Health and gave the promotion a “buy” rating in a research note on Wednesday, November 7. Cantor Fitzgerald reissued the buy rating and published the $96.00 value challenge on the CVS Health promotion in a research note on Thursday, January 3. UBS Group began coverage of CVS Health in a research note on Thursday, January 17. They released a “buy " rating and a $ 75.00 value target on the promotion. In the end, Leerink Swann raised its own price target for CVS Health from $85.00 to $95.00 and gave the firm a “positive” rating in a research note on Thursday, November 8. Once the analyst has described promotion with a sell rating, 2 given hold rating and thirteen have released a buy rating to the promotions company. CVS Health in real time contains an average " Buy " rating and a consensus target of $ 91.79. CVS Health company profile CVS Health Corporation together with its own subsidiaries gives built-in pharmacy honey offers. She works in Offer pharmacy and retail/LTC parts. Pharmacy section invites proposals pharmacy benefits management conclusions the project design and administration, reference manual, program Medicare share D offers, mail order, specialty pharmacy and infusion offerings, retail pharmacy network management proposals, the purpose of systems management, med suggestions, programs for the control of diseases, and medical pharmacy management proposals. | |

|

| |

| Total comments: 0 | |